By using the language of stock markets, this interactive setting invites visitors to metaphorically “invest” in species and ecosystem services. Each of these actions feeds into the simulation, causing the chosen species actor to thrive.

Project partners:

STRP Festival (ACT Award Winner)

Natural resources are currently not considered in the price calculation of goods and services. But clearly, natural systems and their ‘resources’ have a value. For “The Environmentalist Stock Exchange” (short ESX), we took inspiration from ecological economics to integrate the logic of ecosystems into the calculation of the ‘true ecological value’ of a stock market asset. What trading strategies are incentivized in an ecologically driven market?

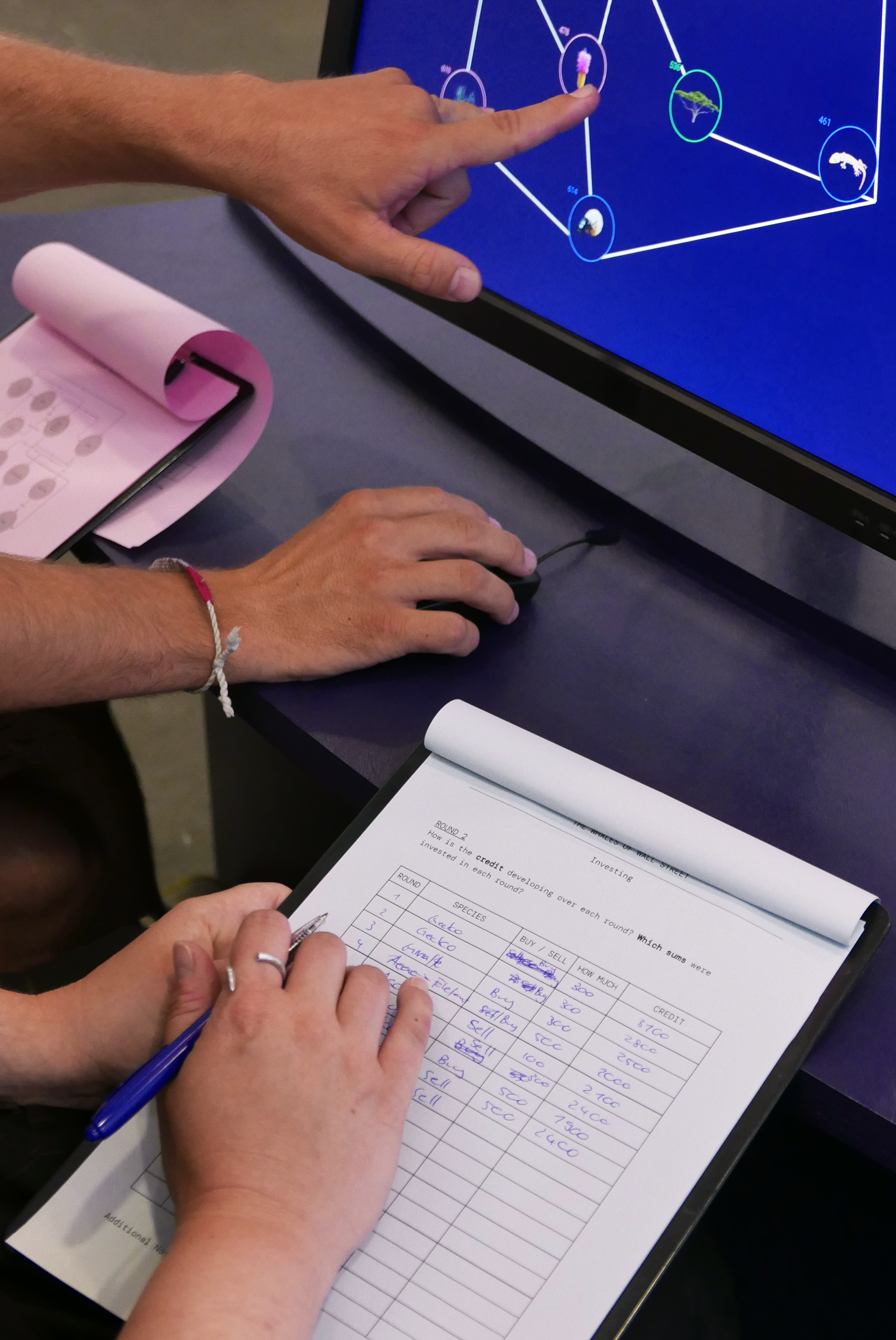

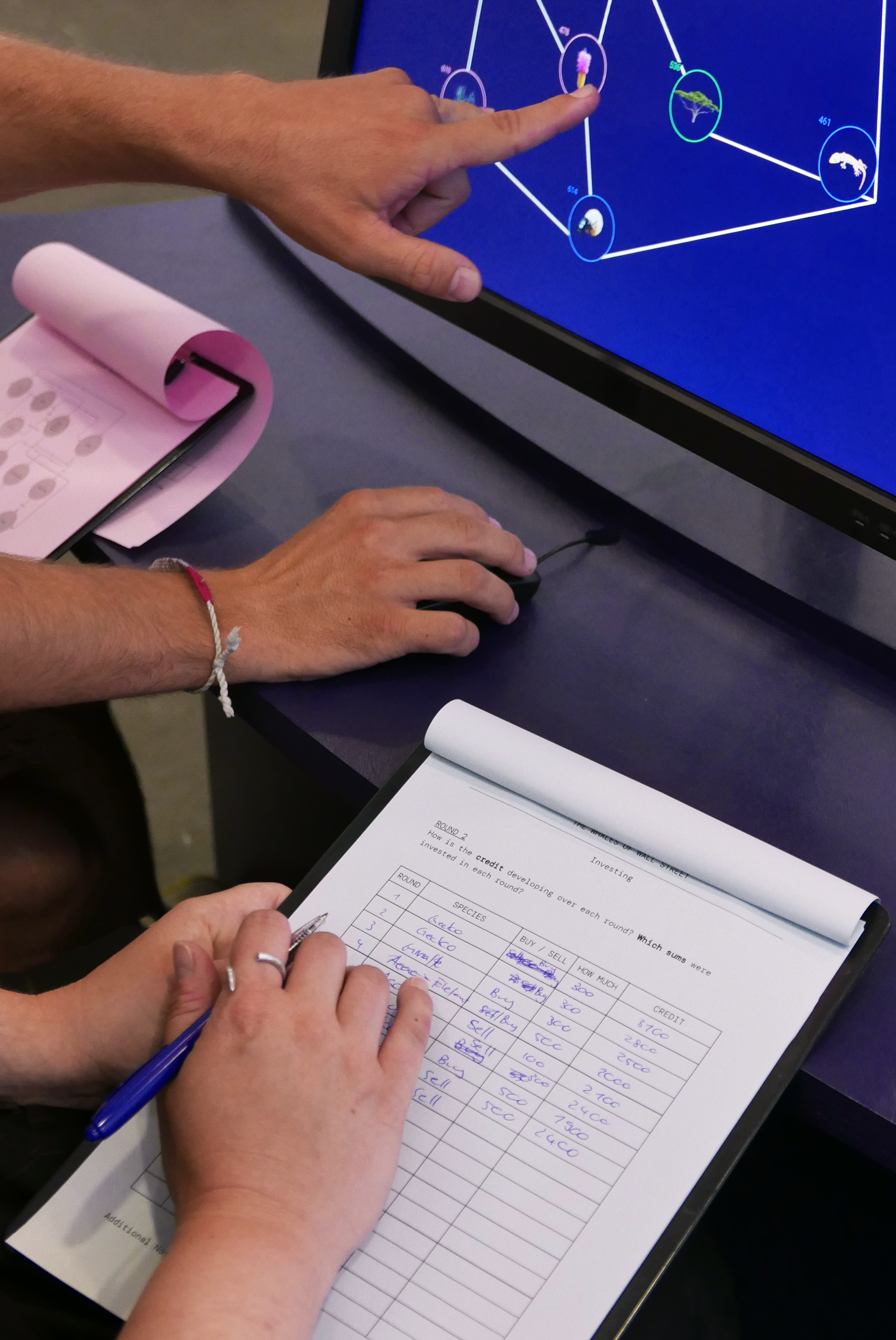

In this alternative stock market, visitors invest in species instead of in companies. Every time a player “buys” or “sells” stocks of a species, it will have an effect on its population in the ecosystem simulation. Graphs and line charts are giving hints in real time about investment opportunities – of stocks that may be undervalued or overvalued. Which species need a financial boost? Investors also receive profit distributions: the better an ecosystem performs, the higher the profit. This exchange (or entanglement) makes investors literally “invested” in the well-being of sea otters, fungi and kelp forests.

On the interface, players can read up on how different species in the ecosystems relate, in order to inform their trading strategy and next moves. Animated dashed lines emitting from the bought/sold species give visual feedback on how each investment affects other neighbouring species (a ‘ripple effect’).

For the simulation’s underlying logic, we determined ideal balance ratios of all species across trophic levels e.g. the ratio between predators : herbivores : plants. We used these ratios to calculate the ecosystem balance level, whether a species’ population is overshooting or lacking. To calculate how an investment affects its nearest neighbour we again focused on trophic levels: if you sell rabbit, there is less food for the wolf (wolf decreases), but grass can recover (increases) which means the direction of the investment ‘ripple effect’ matters. The programmed dynamics between the species is modelled after cases in ecology that are most widely studied.

ESX creates a unique fusion of fields: Taking the principles of market economy and putting them in the framework of ecology allows for interesting comparisons and frictions. Can ecosystems and markets ever be reconciled?

During the 4 days of the STRP Festival in Eindhoven, 8000 people came to visit, among which 2500 students and children. By learning how two species relate to each other visitors could swiftly adjust their investments and succeed in balancing an ecosystem. Listening to group discussions of friends advising the player what to invest in, did feel a bit like how we imagine a trading ring on Wall Street. While most tried to get the ecosystems in balance, a few tried to make as much money as they could. From young to old, we were surprised to see visitors stay with the installation for an average of 10-15 minutes, getting fully absorbed in the experience.

YEAR

2022

LOCATIONS

STRP Festival (NL), Waag Society (NL), Taiwan Design Museum (TW), Mesh Festival (CH)

DESIGN TEAM

Jonas Althaus, Martina Huynh, Polina Slavova (intern), Lindsey Bundel (intern)

RESPONSIBILITIES

Concept, Design Research, Scenography, UI/UX Design, Game Design, Interaction & Electronic design, Exhibition production

COLLABORATORS

Jonas Ersland (development)

SUPPORTED BY

STRP Festival (ACT Award)

PHOTOGRAPHER

Hanneke Wetzer, Boudewijn Bollmann, Cream on Chrome

By using the language of stock markets, this interactive setting invites visitors to metaphorically “invest” in species and ecosystem services. Each of these actions feeds into the simulation, causing the chosen species actor to thrive.

Project partners:

STRP Festival (ACT Award Winner)

Natural resources are currently not considered in the price calculation of goods and services. But clearly, natural systems and their ‘resources’ have a value. For “The Environmentalist Stock Exchange” (short ESX), we took inspiration from ecological economics to integrate the logic of ecosystems into the calculation of the ‘true ecological value’ of a stock market asset. What trading strategies are incentivized in an ecologically driven market?

In this alternative stock market, visitors invest in species instead of in companies. Every time a player “buys” or “sells” stocks of a species, it will have an effect on its population in the ecosystem simulation. Graphs and line charts are giving hints in real time about investment opportunities – of stocks that may be undervalued or overvalued. Which species need a financial boost? Investors also receive profit distributions: the better an ecosystem performs, the higher the profit. This exchange (or entanglement) makes investors literally “invested” in the well-being of sea otters, fungi and kelp forests.

On the interface, players can read up on how different species in the ecosystems relate, in order to inform their trading strategy and next moves. Animated dashed lines emitting from the bought/sold species give visual feedback on how each investment affects other neighbouring species (a ‘ripple effect’).

For the simulation’s underlying logic, we determined ideal balance ratios of all species across trophic levels e.g. the ratio between predators : herbivores : plants. We used these ratios to calculate the ecosystem balance level, whether a species’ population is overshooting or lacking. To calculate how an investment affects its nearest neighbour we again focused on trophic levels: if you sell rabbit, there is less food for the wolf (wolf decreases), but grass can recover (increases) which means the direction of the investment ‘ripple effect’ matters. The programmed dynamics between the species is modelled after cases in ecology that are most widely studied.

ESX creates a unique fusion of fields: Taking the principles of market economy and putting them in the framework of ecology allows for interesting comparisons and frictions. Can ecosystems and markets ever be reconciled?

During the 4 days of the STRP Festival in Eindhoven, 8000 people came to visit, among which 2500 students and children. By learning how two species relate to each other visitors could swiftly adjust their investments and succeed in balancing an ecosystem. Listening to group discussions of friends advising the player what to invest in, did feel a bit like how we imagine a trading ring on Wall Street. While most tried to get the ecosystems in balance, a few tried to make as much money as they could. From young to old, we were surprised to see visitors stay with the installation for an average of 10-15 minutes, getting fully absorbed in the experience.

PROJECT TYPE

Self Initiated

YEAR

2022

LOCATIONS

STRP Festival (NL), Waag Society (NL), Taiwan Design Museum (TW), Mesh Festival (CH)

DESIGN TEAM

Jonas Althaus, Martina Huynh, Polina Slavova (intern), Lindsey Bundel (intern)

RESPONSIBILITIES

Concept, Design Research, Scenography, UI/UX Design, Game Design, Interaction & Electronic design, Exhibition production

COLLABORATORS

Jonas Ersland (development)

PHOTOGRAPHER

Hanneke Wetzer, Boudewijn Bollmann, Cream on Chrome